REPOST: Approval Of Natural-Gas Export Project Gets Mixed Reaction From Lawmakers

As pressure builds on the Obama administration, the Energy Department ifinally gave an approval for more U.S. natural gas exports on Monday. Read more in this TheWallStreetJournal.com article.

WASHINGTON—The Obama administration's approval of a seventh application to export natural gas drew cautious praise from a number of U.S. lawmakers who have been putting pressure on President Barack Obama to allow more gas exports as a way to weaken Russia's power over Ukraine.

"I am proud that the U.S. Department of Energy has heeded my calls to speed its approval of pending liquefied-natural-gas export terminals," Sen. Mark Udall, (D., Colo.) said in a statement following the Energy Department's announcement Monday that it was granting conditional approval for Jordan Cove, a proposed project to export natural gas out of Oregon. "This newly approved LNG [liquefied natural gas] terminal is a step in the right direction, but there is more to do. I will keep fighting to ensure the White House continues to prioritize the development and approval of additional natural-gas export facilities."

Mr. Udall's statement is notable because he is one of a number of Democrats facing a tough re-election fight this year, and Republicans have targeted his seat as they try to capture a majority of the Senate. Mr. Udall hasn't always been so outspoken on this issue and he is widely viewed as aligned with environmentalists and renewable-energy interests just as much, if not more, than the natural-gas sector. Mr. Udall will face Rep. Cory Gardner, (R., Colo.), who recently announced his candidacy.

Jordan Cove is the seventh application, of more than 20, to receive the Energy Department's conditional approval, which allows the project to move forward but doesn't guarantee it will. Only one project has final federal approval to export natural gas and it is expected to begin doing so in late 2015. Before Jordan Cove and the other five projects that have won conditional approval can be built, they must get final clearance from the Federal Energy Regulatory Commission.

Brendan Buck, spokesman for House Speaker John Boehner (R., Ohio), who has been one of the most vocal critics of Mr. Obama's energy policies, said Monday "this is welcome news for those opposed to Russia's aggression, but the approval of one application—which has been waiting two years—doesn't suggest that the president has adopted a new approach." Mr. Buck said the administration must approve the remaining projects "if we're going to weaken Russia's dominance in many foreign energy markets."

Ukraine and many other European nations rely on Russia for their natural gas, and over the last several weeks both U.S. lawmakers and ambassadors from Eastern European nations have been urging Mr. Obama to approve greater LNG exports to chip away at Russia's regional energy dominance.

Three congressional hearings this week-two on Tuesday and one Wednesday-will examine how the U.S. can use its abundant natural-gas resources as a geopolitical tool. Tuesday's hearings feature officials at the Energy Department, which has primary jurisdiction over this review process.

The department last approved a natural-gas export project in Louisiana a little over a month ago—a shorter period than the previous six approvals, which took up to two to three months to be approved. The timing signals that the Energy Department may be giving more consideration to geopolitical factors in its approval process.

Energy Secretary Ernest Moniz indicated as much at a Bloomberg Government event last week. "Maybe we will give some additional weight to the geopolitical criterion going forward," he said.

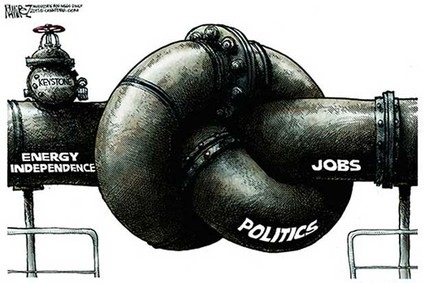

The Federal Energy Regulatory Commission—the next step in the approval process—is coming under intense scrutiny from environmentalists opposed to using natural gas and from U.S. industries that rely on it and predict its price will rise as exports increase. Some Democratic lawmakers, wary of price increases, said Monday that the Jordan Cove approval is a step too far, putting American jobs at risk.

"There can be no doubt that we have crossed a line into an era when we could be massively exporting America's natural gas, sending the jobs and consumer benefits abroad along with the fuel," said Sen. Edward Markey, (D., Mass.), who sits on the Senate Foreign Relations Committee.

A coalition of major companies, including Dow Chemical Co. and Alcoa Inc., that use natural gas in production processes issued a statement Monday criticizing the administration's move.

"This is a grievous error that puts billions of dollars of investment and millions of jobs at risk," the group America's Energy Advantage wrote in a statement. "This latest export approval will raise domestic natural gas, electricity, home-heating and propane prices for every American, undermine our manufacturing competitiveness and cost the nation good-paying jobs."

Both Mr. Markey and the coalition are calling on the administration to halt further approvals until it conducts a study reviewing current market conditions.

The Obama administration is restricted by a law that establishes regulatory hurdles for the U.S. to export natural gas to countries that aren't free-trade partners, which include most of the countries that most want U.S. gas: Japan, India and European nations. To comply with the export law, the Energy Department must determine that the gas shipments are in America's national interest after considering several factors, such as economic, environmental and geopolitical issues.

In its order approving the Jordan Cove project, the Energy Department gave a specific nod to how America's natural-gas boom is already helping U.S. allies.

"Increased production of natural gas has significantly reduced the need for the United States to import LNG," the 158-page order states. "In global trade, LNG shipments that would have been destined to U.S. markets have been redirected to Europe and Asia, improving energy security for many of our key trading partners. To the extent U.S. exports can diversify global LNG supplies, and increase the volumes of LNG available globally, it will improve energy security for many U.S. allies and trading partners."

Get more perspective on the energy industry by following this Ali Ghalambor Twitter page.

RSS Feed

RSS Feed